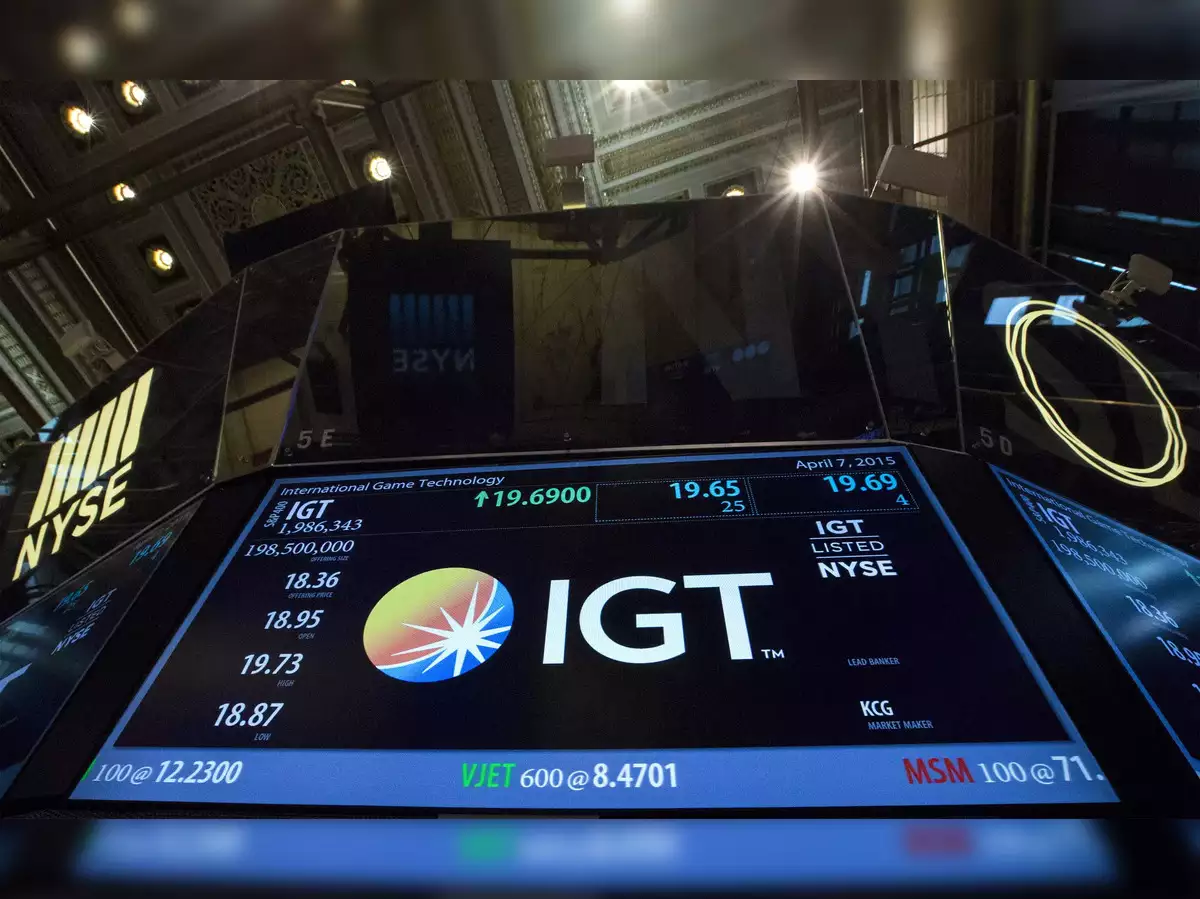

International Game Technology, Everi Technology To Merge in Mega-Deal

IGT has announced its merger with Everi Holdings, deviating from the earlier expectation of spinning off its slot machine business. The $6.2-billion deal values IGT at $4 billion and Everi at $2.2 billion. IGT will spin off its Global Gaming and PlayDigital units, combining them with Everi to create a global gaming and fintech enterprise.

The IGT Global Lottery unit will remain separate. Everi’s Michael Rumbolz becomes chairman, IGT’s Vince Sadusky becomes CEO, and key leadership roles are shared.

The board will have 11 members, with IGT appointing six, De Agostini S.p.A. appointing three, and Everi appointing two. After closure, IGT shareholders will hold 54%, and Everi shareholders 46%. This move reshapes the gaming and fintech sectors.

IGT envisions the merger as a comprehensive gaming industry hub, spanning land-based gaming, gaming, sports betting, and fintech. The projected 2024 revenue is $2.7 billion, with an expected $1 billion cash flow and estimated cost savings of $85 million from the merger.

IGT anticipates a debt-to-cash-flow ratio of 3.2 to 3.4 post-approval, showing a swift path to deleveraging. De Agostini and other shareholders will be compensated with 103,400,000 Everi shares, securing a majority position.

The combined entities are forecasted to generate $800 million in cash flow in the second year, with $2.6 billion in cash financing the deal. This funding will mainly retire IGT debt, with $600,000 allocated for separation expenses, tax leakage and corporate purposes.

The merged company, upon completion, will operate 70,000 electronic gambling machines, generating substantial recurring revenues.

IGT highlights the creation of a Premier IP portfolio, consolidating successful game franchises across various product verticals to strengthen its market presence.

Truist Securities analyst Barry Jonas shared insights on the merger, noting that the deal lacks substantial premiums but has the potential to establish a powerful gaming-tech entity over time. He also highlighted the importance of recognizing key execution challenges and short-term disruption risks for investors.

Jonas expressed concerns about an extended regulatory approval process, which could create disruption challenges and short-term uncertainty.

Furthermore, the analyst raised the prospect of Play AGS, the last remaining small independent public manufacturer. It’s facing pressure to take corporate actions in response to the united IGT/Everi entity.

Despite challenges, he acknowledged the formidable potential of a consolidated IGT/Everi. Jonas believes that, at first glance, the merger between IGT and Everi offers more value than the alternative of an IGT Gaming/Digital spin-off.

The integration of Everi’s financial technology with IGT’s gaming systems is seen as creating a comprehensive all-in-one offering, particularly with Everi’s strength in tribal casinos.

While adopting a cautious approach, Jonas finds the projected $85 million in savings reasonable, acknowledging past instances where synergies did not always materialize.

The new entity is expected to benefit from reduced Italian geopolitical risk and a smoother capital expenditure cycle. Upon completion of the transaction, the IGT ticker symbol will be retired, and a new symbol, yet to be announced, will represent the merged identity.

- Other news categories:

- SlotsUp's news