DraftKings on long list of betting companies targeting Brazil foray

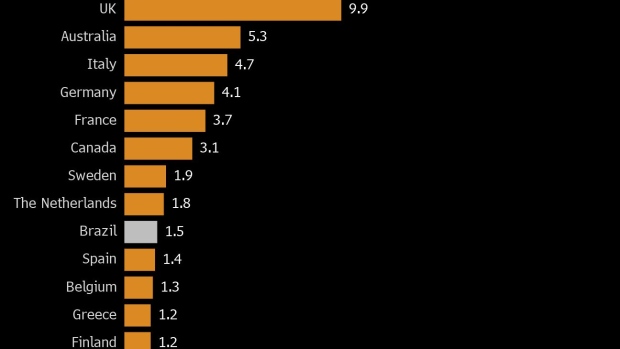

Brazil has been given the green light for online regulated gambling, and a phalanx of US betting companies are now mulling over moves to enter the potentially lucrative market.

DraftKings are among the nearly 135-strong cohort of US gambling behemoths targeting a foray into Brazil which looks set to become the next major sports betting frontier.

The list of those willing to procure a Brazil betting license reads like a who’s who of iGaming, while MGM Resorts and Hard Rock International are also exploring avenues.

Brazil, which passed a vote to legalize sports betting and iGaming passed the chamber of deputies last year, and the allure of Latin America is certainly very appealing. This is perhaps more topical given that state-level legalization is slowing in some places, and there is growing belief it could be years before California and Texas permit mobile sports betting.

Among the other US-based firms who are weighing up entering Brazil, include Bally’s, while entities with ties to European sportsbooks Entain and Betfair are also considering making inroads.

Perhaps more intriguingly, the path to liberalize iGaming in Brazil could open the way for rumored takeover target Rush Street Interactive to draw more interest from prospective suitors.

Last month, it was revealed that RSI had been approached by multiple companies over a takeover, although the company refused to publicly confirm talks had taken place.

RSI is currently the only US-based iGaming company that has an established footprint in Latin America, operating in Colombia and Mexico, and it is thought it could eventually pitch up in Argentina and Peru.

As far as Brazil is concerned, US-based betting companies want to get in on the action.

Although the new law indicates that gaming operators will have to pay $5.9 million to secure a license, financial projections have suggested total gross gaming revenues could soar to nearly $5 billion over the next five years.

Moreover, with a 12% tax rate imposed on gross gaming revenues, this could potentially price smaller players out of the market.

This is something that was recognized by Wesley Cardia, President of Brazil’s National Association of Games and Lotteries, who was discussing his thoughts on Brazil’s progression to a more structured market.

He said: “It’s one of the biggest markets in the world, and as it gets regulated and becomes a formal market, it allows companies to enter and better explore the system.

“And when you take those small and not well-regarded websites out of the market, you aggregate consumers to the big ones.”

Brazil, which is a soccer-obsessed country, will also host its first NFL game in Sao Paulo this year, and this has been fueled by an increased demand.

Although Brazil faces challenges, the room for growth in a competitive global market remains undeniable, and the aforementioned betting companies will want to strike while the iron is hot.

- Other news categories:

- SlotsUp's news